Our 2023 tax return checklist is now available on our website. Please complete and send it to us for processing:

News

2024 Individual Tax Return Checklist

Our 2024 tax return checklist is now available on our website. Please complete and send it to us for processing:

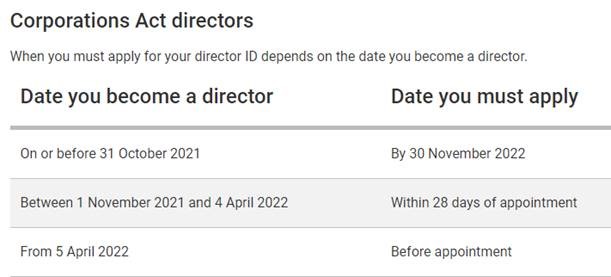

New director ID requirement

We are writing to let you know about the director identification number (director ID) requirement that has been introduced and now available to apply on the new Australian Business Registry Services (ABRS) website.

ABRS is a new service, managed by the Australian Taxation Office, that will streamline how you register, view and maintain your business information with government. It is part of the Modernising Business Registers (MBR) program and the first service to be delivered.

A director ID is a unique identifier a director applies for once and keeps forever. It will help prevent the use of false or fraudulent director identities. A person will keep their director ID even if they stop being a company director, change their name or move interstate or overseas. It confirms a director’s identity and will in the future show which companies they’re linked to.

As you are already a Company Director, you will need to apply for a director ID. We can’t apply on your behalf as the Registrar needs to verify your identity.

When to apply

It’s free to apply and the fastest way to apply is online. The ABRS has other options available for those who can’t apply online. See Apply for your director ID

You will need a myGovID with a Standard or Strong identity strength to apply for a director ID online. If you don’t have the myGovID app you can set it up at https://www.mygovid.gov.au/set-up

You will also need to verify information held on your ATO record, such as a Notice of assessment. Once you have this information, the online application is intuitive and takes less than 5 minutes. You will get

your director ID instantly. Once you do, please pass on the information to us asap.

This video can also assist with what is needed. Introduction to director ID and overview .Director ID overview

To find out more about the ABRS, its role in administering delegated ASIC Registry functions and director ID visit abrs.gov.au/about-us.

Please let us know if you have any questions or queries.

Year-end considerations

Single Touch Payroll (STP) for closely held payees

STP has applied to small employers (fewer than 20 payees) since 1 July 2019. However, until 30 June 2021, small employers have been exempt from reporting amounts paid to closely held payees through STP. This exemption recognised that, in many family-run businesses, family member payments may have been irregular and may only have been formalised after year-end. The exemption includes the usual family members as well as director-employees and trust beneficiaries of small businesses.

This exemption did not extend to arm’s length employees of small employers. In such cases, small employers are already required to report through STP.

From 1 July 2021, this exemption will no longer apply; that is, the two-year deferral will come to an end. This means that, where the payer is already reporting arm’s length employees through STP, payments to closely held payees will now also need to be reported. For those payers that have been able to enjoy the deferral completely on the basis that they only had closely held payees, they will now need to start reporting these payments through STP.

Reporting of payments must be made either on or before the date of payment or quarterly at the time the BAS is due (includes any lodgment deferrals applicable to the activity statement). It is possible to report a reasonable estimate of the amount that reflects the circumstances of the closely held payee, provided the circumstances are similar to those in the last year the employer completed a finalisation declaration for the closely held payee or last finalised a payment summary annual report (PSAR). In reporting a reasonable estimate in this case, the ATO will accept year-to-date figures being 25%, 50%, 75% and 100% of the previously reported amount for each quarter (e.g. 25% of payments in the year ended 30 June 2020 when reporting for the September 2021 quarter, 50% of payments when reporting for the December 2021 quarter etc.).

Corporate tax rate and franking rates reduce to 25%

Companies that are base rate entities will be subject to a corporate tax rate of 25% in the 2021–22 income year and future years. This is down from the rate of 26% that applied for the 2020–21 income year.

A base rate entity is a company that has an aggregated turnover of less than $50 million and no more than 80% of their assessable income is base rate entity passive income.

As mentioned in last week’s preamble, the reducing corporate tax rate can have an impact on the franking and distribution of dividends. Profits taxed at a higher rate in one year may only be able to be franked at a lower rate in a later year. So, while the reducing corporate tax rate may, at first blush, be something to think about when completing the first quarter activity statements for 2021–22, it is something to consider before 30 June 2021 in the context of dividend strategies and franking.

Superannuation changes

Superannuation Guarantee Charge (SGC) rate increase from 9.5% to 10%

While there has been much press around the debates regarding the possible deferral of increases to the rate of SGC, most practitioners will be fully aware that the increase in the SGC obligation from 9.5% to 10% applies from 1 July 2021. Nonetheless, some care may need to be taken before simply increasing superannuation contributions for every employee from 1 July 2021.

While other changes announced in the recent Federal Budget 2021–22 (e.g. the abolition of the $450 monthly minimum income threshold before SGC contributions are required) don’t apply before 1 July 2022, the requirement to make superannuation contributions is still dependent on whether the payee is an employee or otherwise covered by SGC obligations. Not all ‘contractors’ are excluded from the SGC requirement, in particular if the contract is principally for the labour of the contractor. Directors, entertainers, sportspeople and artists are also covered.

Difficulties in interpretation may emerge in determining whether someone is engaged on a superannuation-inclusive or salary plus superannuation package. In those cases, regard may need to be had to award obligations as well as the employment contract. Renegotiating the payment arrangements under the contract may be an option pre-30 June 2021.

Indexation of contributions caps

The superannuation concessional contributions cap increases from $25,000 to $27,500 with effect from 1 July 2021. Similarly, the non-concessional contributions (NCC) cap will increase from $100,000 to $110,000 from 1 July 2021.

Firstly, it is crucially important not to confuse the contribution limits for the current year when making last minute contributions prior to 30 June 2021. It is easy enough to make this mistake in the rush of year-end planning only to find that the three-year bring forward rule for NCCs has been triggered potentially limiting future non-concessional contributions. Or that an excess concessional contribution has triggered an unwanted and unplanned tax liability.

On the other hand, the increase in contribution limits may encourage some clients to defer retirement until after 1 July 2021 to take advantage of another year of (increased) contributions.

Indexation of transfer balance cap from $1.6m to $1.7m

Another superannuation limit that is increasing is the transfer balance cap (TBC). This is the amount that a member can have at commencement of a superannuation pension in their superannuation fund, the income and gains from which will be exempt from tax. For clients considering retirement, this is a good reason to defer commencing a pension until after 30 June 2021 as this will mean income and gains on an additional $100,000 of assets backing a superannuation pension can be free from tax.

Any income or gains on amounts in excess of this limit in the fund at the commencement of the pension will continue to be subject to tax at the 15% superannuation rate (subject to any CGT discount that may apply). Source: Tax Institute

New Office Location – Update

We are writing to advice you of some exciting news! We have moved our business to a new location in Narre Warren.

Our new business address is Level 1, 64 Victor Crescent Narre Warren VIC 3805.

We are still happy to meet you in our Dandenong or Narre Warren North offices if that’s of convenient to you.

Our postal address however, will remain the same as, PO Box 815 Endeavour Hills VIC 3804

2020 tax season update

Please note: With the current COVID-19 restrictions, we will be conducting phone appointments throughout the 2020 tax season, until further notice.

STAY SAFE!!

2020 Individual Tax Return Checklist

Our 2020 tax return checklist is now available in our website. Please go to https://www.atpartners.com.au/wp-content/uploads/2020/08/Check-List-Personal-2020.pdf

COVID-19 update – Help for individuals and businesses

Hello Everyone,

Hope you are all well and keeping safe .

Please find below details of the most recent incentive introduced to employers & individuals.

JobKeeper Payment

The Government has announced temporary scheme called a “JobKeeper Payment” for employers, employees and sole traders. Businesses impacted by the coronavirus will be able to access a subsidy from the Government to continue paying their employees. Affected employers will be able to claim a fortnightly payment of $1,500 per eligible employee from 30 March 2020, for a maximum period of 6 months.

Self-employed people and sole traders with or without employees, may be eligible to receive the JobKeeper Payment if their turnover has reduced.

Please click below for more details.

Find more details and to check your eligibility, please click this link.

If you are eligible, please register your interest asap using this link.

https://www.ato.gov.au/general/gen/JobKeeper-payment/

JobSeeker Payment-Individuals

The Government is temporarily expanding eligibility to income support payments and establishing a new, time-limited Coronavirus supplement to be paid at a rate of $550 per fortnight. This supplement will be paid to both existing and new recipients of the eligible payment categories. These changes will apply for the next six months.

To see your eligibility, please click the link below

https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet-Income_Support_for_Individuals_0.pdf

Victorian Business Support Fund

The Victorian Government has launched the $500 million Business Support Fund to help small businesses survive the impacts of the coronavirus (COVID-19) pandemic and keep people in work. Funding of $10,000 per business is available and will be allocated through a grant process.

To see your eligibility and to apply, please click the link below. Applications close on 01 June 2020.

Should you have any questions, please do not hesitate to contact me.

Stay Safe!!

Kind Regards,

Tharanga Pathiranage CTA

Partner

COVID-19: Message from A.T. Partners Accountants & Business Advisors Pty Ltd

Message from A.T. Partners Accountants & Business Advisors Pty Ltd

Due to the COVID-19 Outbreak, our office is temporally closed for the public.

Our usual business services are still continuing as normal via phone and online.

Should you have any questions, please contact us on 03 9794 7058 or email [email protected]

Please visit https://www.dhhs.vic.gov.au/coronavirus if you require more information about COVID-19

STAY SAFE EVERYONE!!

Director – Tharanga Pathiranage

COVID-19: Important information from A.T Partners Accountants & Business Advisors

Dear Valued Client,

In these unprecedented times, we wanted to reach out to let you know what we are doing to support our team, our clients, and our community to get through the uncertainties we all face.

In accordance with our Business Continuity Plan, we have already taken measures to ensure that we are able to provide the same level of service with as little impact as possible to our clients and employees.

Being healthy and safe

Our priority is to make sure we’re focused on the health, well being and safety of our team and our clients. We’ve also deferred any non-essential travel for the foreseeable future.

Ways we can support you

Most of the data and communications are stored in the cloud and currently all of our staff are set up with the appropriate technological infrastructure to work from home.

The Australian Government’s position and the advice of health organisations is that most infectious diseases can be controlled with improved social distancing, therefore we have implemented the following measures:

- Encouraging working from home arrangements (as implemented above)

- Encouraging meetings via teleconference or via Zoom (inclusive of both Staff and Client meetings).

- Ensuring all staff are aware of how to protect themselves and others as per the guidelines listed on the Australian Government Department of Health’s website.

Our lines of communication will remain open and we will continue to operate during business hours.

In the event of any lock down or isolation measures being enforced by the government, we believe A.T Partners will be well-equipped to continue assisting our clients with little to no disruption.

We do note that some services such as registered post mail or face-to-face meetings may be impacted by Government regulations.

Advising clients in troubled times

The Australian Taxation Office (ATO) has introduced various stimulus packages to support the Australian Businesses, during this crisis. We will be actively reviewing client eligibility against their criteria. Below is the government issued fact sheet about cash flow assistance for businesses.

https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet-Assistance_for_businesses.pdf

The Australian Taxation Office (ATO) will implement a series of administrative measures to assist Australians experiencing financial difficulty as a result of the COVID-19 outbreak. More information can be find in below ATO web link.

https://www.ato.gov.au/Media-centre/Media-releases/Support-measures-to-assist-those-affected-by-COVID-19/

We hope this advice provides you with clarity on our continued professional services and we will continue to monitor this situation and keep our clients updated accordingly.

Should you have any questions or concerns, do not hesitate to contact me directly, or alternatively you may wish to contact our office.

Stay safe everyone!

Thanks

Kind Regards,

Tharanga Pathiranage CTA

- 1

- 2