Our 2024 tax return checklist is now available on our website. Please complete and send it to us for processing:

Archives for Uncategorized

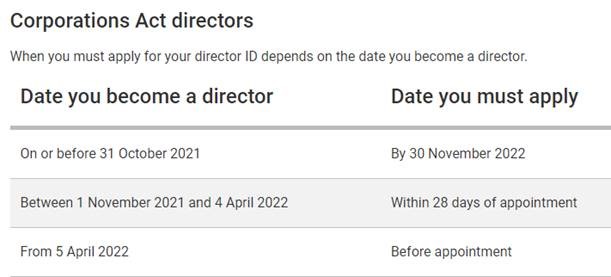

New director ID requirement

We are writing to let you know about the director identification number (director ID) requirement that has been introduced and now available to apply on the new Australian Business Registry Services (ABRS) website.

ABRS is a new service, managed by the Australian Taxation Office, that will streamline how you register, view and maintain your business information with government. It is part of the Modernising Business Registers (MBR) program and the first service to be delivered.

A director ID is a unique identifier a director applies for once and keeps forever. It will help prevent the use of false or fraudulent director identities. A person will keep their director ID even if they stop being a company director, change their name or move interstate or overseas. It confirms a director’s identity and will in the future show which companies they’re linked to.

As you are already a Company Director, you will need to apply for a director ID. We can’t apply on your behalf as the Registrar needs to verify your identity.

When to apply

It’s free to apply and the fastest way to apply is online. The ABRS has other options available for those who can’t apply online. See Apply for your director ID

You will need a myGovID with a Standard or Strong identity strength to apply for a director ID online. If you don’t have the myGovID app you can set it up at https://www.mygovid.gov.au/set-up

You will also need to verify information held on your ATO record, such as a Notice of assessment. Once you have this information, the online application is intuitive and takes less than 5 minutes. You will get

your director ID instantly. Once you do, please pass on the information to us asap.

This video can also assist with what is needed. Introduction to director ID and overview .Director ID overview

To find out more about the ABRS, its role in administering delegated ASIC Registry functions and director ID visit abrs.gov.au/about-us.

Please let us know if you have any questions or queries.

New Office Location – Update

We are writing to advice you of some exciting news! We have moved our business to a new location in Narre Warren.

Our new business address is Level 1, 64 Victor Crescent Narre Warren VIC 3805.

We are still happy to meet you in our Dandenong or Narre Warren North offices if that’s of convenient to you.

Our postal address however, will remain the same as, PO Box 815 Endeavour Hills VIC 3804

2020 tax season update

Please note: With the current COVID-19 restrictions, we will be conducting phone appointments throughout the 2020 tax season, until further notice.

STAY SAFE!!

COVID-19 update – Help for individuals and businesses

Hello Everyone,

Hope you are all well and keeping safe .

Please find below details of the most recent incentive introduced to employers & individuals.

JobKeeper Payment

The Government has announced temporary scheme called a “JobKeeper Payment” for employers, employees and sole traders. Businesses impacted by the coronavirus will be able to access a subsidy from the Government to continue paying their employees. Affected employers will be able to claim a fortnightly payment of $1,500 per eligible employee from 30 March 2020, for a maximum period of 6 months.

Self-employed people and sole traders with or without employees, may be eligible to receive the JobKeeper Payment if their turnover has reduced.

Please click below for more details.

Find more details and to check your eligibility, please click this link.

If you are eligible, please register your interest asap using this link.

https://www.ato.gov.au/general/gen/JobKeeper-payment/

JobSeeker Payment-Individuals

The Government is temporarily expanding eligibility to income support payments and establishing a new, time-limited Coronavirus supplement to be paid at a rate of $550 per fortnight. This supplement will be paid to both existing and new recipients of the eligible payment categories. These changes will apply for the next six months.

To see your eligibility, please click the link below

https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet-Income_Support_for_Individuals_0.pdf

Victorian Business Support Fund

The Victorian Government has launched the $500 million Business Support Fund to help small businesses survive the impacts of the coronavirus (COVID-19) pandemic and keep people in work. Funding of $10,000 per business is available and will be allocated through a grant process.

To see your eligibility and to apply, please click the link below. Applications close on 01 June 2020.

Should you have any questions, please do not hesitate to contact me.

Stay Safe!!

Kind Regards,

Tharanga Pathiranage CTA

Partner

COVID-19: Message from A.T. Partners Accountants & Business Advisors Pty Ltd

Message from A.T. Partners Accountants & Business Advisors Pty Ltd

Due to the COVID-19 Outbreak, our office is temporally closed for the public.

Our usual business services are still continuing as normal via phone and online.

Should you have any questions, please contact us on 03 9794 7058 or email [email protected]

Please visit https://www.dhhs.vic.gov.au/coronavirus if you require more information about COVID-19

STAY SAFE EVERYONE!!

Director – Tharanga Pathiranage

COVID-19: Important information from A.T Partners Accountants & Business Advisors

Dear Valued Client,

In these unprecedented times, we wanted to reach out to let you know what we are doing to support our team, our clients, and our community to get through the uncertainties we all face.

In accordance with our Business Continuity Plan, we have already taken measures to ensure that we are able to provide the same level of service with as little impact as possible to our clients and employees.

Being healthy and safe

Our priority is to make sure we’re focused on the health, well being and safety of our team and our clients. We’ve also deferred any non-essential travel for the foreseeable future.

Ways we can support you

Most of the data and communications are stored in the cloud and currently all of our staff are set up with the appropriate technological infrastructure to work from home.

The Australian Government’s position and the advice of health organisations is that most infectious diseases can be controlled with improved social distancing, therefore we have implemented the following measures:

- Encouraging working from home arrangements (as implemented above)

- Encouraging meetings via teleconference or via Zoom (inclusive of both Staff and Client meetings).

- Ensuring all staff are aware of how to protect themselves and others as per the guidelines listed on the Australian Government Department of Health’s website.

Our lines of communication will remain open and we will continue to operate during business hours.

In the event of any lock down or isolation measures being enforced by the government, we believe A.T Partners will be well-equipped to continue assisting our clients with little to no disruption.

We do note that some services such as registered post mail or face-to-face meetings may be impacted by Government regulations.

Advising clients in troubled times

The Australian Taxation Office (ATO) has introduced various stimulus packages to support the Australian Businesses, during this crisis. We will be actively reviewing client eligibility against their criteria. Below is the government issued fact sheet about cash flow assistance for businesses.

https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet-Assistance_for_businesses.pdf

The Australian Taxation Office (ATO) will implement a series of administrative measures to assist Australians experiencing financial difficulty as a result of the COVID-19 outbreak. More information can be find in below ATO web link.

https://www.ato.gov.au/Media-centre/Media-releases/Support-measures-to-assist-those-affected-by-COVID-19/

We hope this advice provides you with clarity on our continued professional services and we will continue to monitor this situation and keep our clients updated accordingly.

Should you have any questions or concerns, do not hesitate to contact me directly, or alternatively you may wish to contact our office.

Stay safe everyone!

Thanks

Kind Regards,

Tharanga Pathiranage CTA